If you total your car, do you know if your policy covers a total replacement? It’s important to understand what your policy covers for auto replacement.

Read MoreBlog

Wisconsin DMV to eliminate “On The Road” Testing?

The mandatory “On The Road Driving Test” as a requirement for getting your Drivers License is now in the process of being eliminated effective 5/11/20 by the Wisconsin Department of Motor Vehicles.

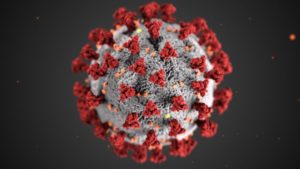

Read MoreCorona Virus Update

Over the past 2 months, Gary and I have answered hundreds of customer phone calls about these rebates, rate revisions, and billing questions.

Read More“I Don’t Drive This Car In The Winter, Take It Off My Policy”

We get this type of request a lot in the fall, mostly with Corvettes, Classic Cars, and other High-Value Vehicles that don’t handle well in the winter months.

Read MoreIt’s Pot Hole Season!

Potholes are a huge nuisance to drivers these days here in Wisconsin, and especially in the city of Milwaukee. we can help you determine the best course of action in this situation.

Read MorePlanning for the Future: How to Prepare for Long-Term Care

Planning for the future is never easy; there are so many things to consider, and when it comes to your senior years

Read More